michigan unemployment income tax refund

Individuals who owed tax on their original return may have deferred their tax payments to a later date such as the Michigan extended filing date May 17 2021. Michigan residents who paid taxes on unemployment benefits in 2020 must file an amended tax return with the state in order to get that money back.

Michigans state income tax is 425.

. That means the average refund for one week of unemployment from last spring and summer would be roughly 40. Michigan unemployment officials say 12 million residents about 25 percent of the states labor force should receive a 1099 tax form by the end of February. Please allow the appropriate time to pass before checking your refund status.

There is no state-level deduction for the unemployment. Under the rule change single taxpayers are able to exclude up to 10200 of unemployment benefits received in 2020 from taxable income on their federal returns or as. The refund checks were announced in March after the passage of the American Rescue Plan Act which exempted up to 10200 in taxable income on unemployment.

North Dakota taxes unemployment compensation to the same extent that its taxed under federal law. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. State Taxes on Unemployment Benefits.

Federal tax rates are. Allow 2 weeks from the date you received confirmation that your e-filed state return was. State Income Tax Range.

The Michigan Department of Treasurys Taxpayer Advocate provided our team with the following update.

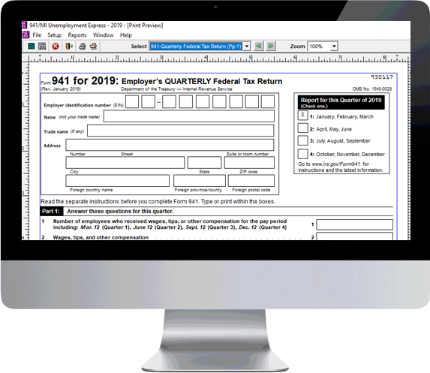

Mi Sales Tax Software W 2 1099 Reporting Software 940 941 Reporting Software

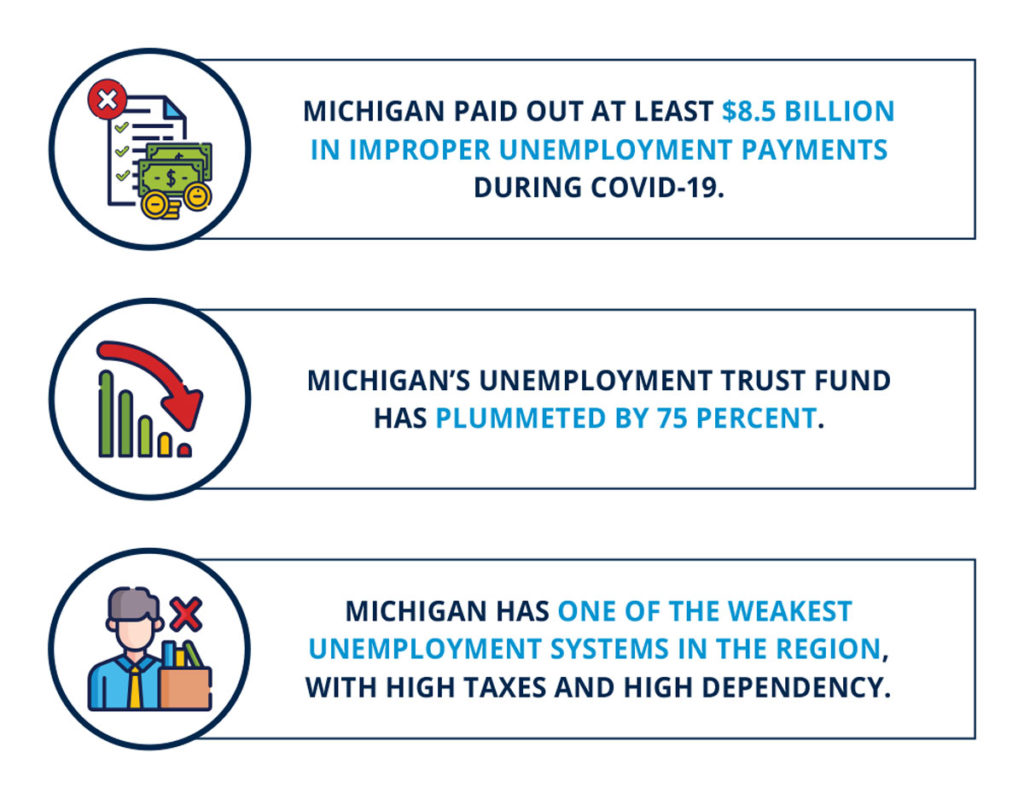

Michigan Workers Are Being Asked To Repay Thousands In Uia Benefits Received During The Pandemic

Michigan Finally Releases Tax Forms For Those Who Were Jobless In 2021

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

Rebound Filing Taxes After Getting Unemployment Benefits

Michigan Finally Releases Tax Forms For Those Who Were Jobless In 2021

Michigan Unemployment Benefits For Limited Liability Company Members Rehmann

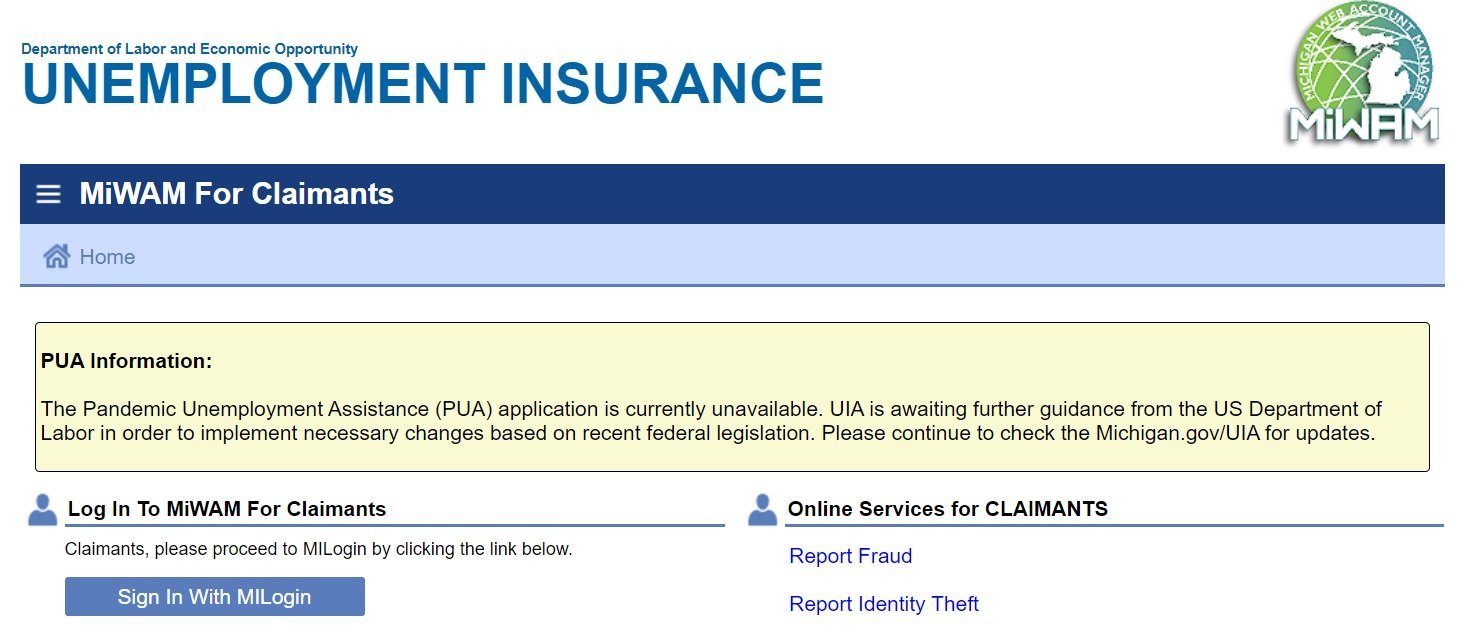

Michigan Unemployment System Designed To Slow Payments Working All Too Well Bridge Michigan

Michigan S Unemployment System Is Broken But Can Be Fixed

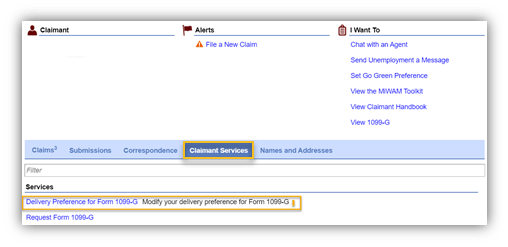

Step By Step Instructions For Filing For Unemployment In Michigan If You Are Self Employed Michigan Unemployment Help Unemployment Career Purgatory

Irs Issues 510 Million In Refunds To Taxpayers Who Overpaid On Unemployment

Notice Treatment Of Unemployment Compensation For Tax Year 2020

What Is A 1099 G Form And What Do I Do With It

Michigan Question About Generic Availability R Unemployment

Mi Oficina Income Tax Insurance File Your Taxes With Mi Oficina Income Tax And Get The Maximum Refund Fast This Year You Will Qualify For Additional Credits If You

Michigan Some May Need To Amend Their Federal Tax Return If The 10 200 Tax Break Entitles Them To New Tax Credits Like The Eitc R Unemployment

Michigan Anyone Get The Pua Questionnaire In Their Claim What Are They Asking For Here I Do Have W2 Income But Not 1099 If I Put 0 For This Am I Going